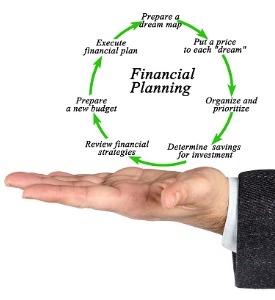

Financial Planning

Financial Planning is a collaborative process that helps maximize a Client’s potential for meeting life goals through Financial Advice that integrates relevant elements of the Client’s personal and financial circumstances.

Financial Planning is a collaborative process that helps maximize a Client’s potential for meeting life goals through Financial Advice that integrates relevant elements of the Client’s personal and financial circumstances.

Think of a comprehensive financial plan as a road map. If I am in New York and want to travel to Seattle, I might get there if I generally head West and North. But, the likelihood of getting lost and backtracking is substantial. It would take more time, be more expensive and, I would guess, be more stressful to embark on this type of journey.

If, instead, I got hold of a good map, highlighted the best route and set off, I would travel with the confidence that I know the specific roads I am traveling, the landmarks in the journey, the estimated cost of the trip, and how long it will take to get there. If I make a wrong turn, or get a flat tire, at least I can easily get back on track. These are the benefits that come from using a map to get from here to there: the same benefits that come from mapping the course from here to there, financially speaking.

The Planning Process

We do not consider financial planning a one-time event that crunches numbers into a computer which then generates a static set of graphs and charts to be stored on your bookshelf. It’s much more dynamic and valuable than that.

At Planning With A Purpose At Halliday Financial, we view financial planning as a comprehensive, ongoing process that starts with helping you define your vision of financial success, developing a plan to help you get there, then tracking your progress along the way, recommending changes where needed.

True financial planning is based on a long-term, productive, communicative relationship with a financial advisor to develop a comprehensive, ongoing approach to managing all areas of your financial life. For many people, having a financial plan helps them feel more confident about their financial future.

Benefits of Financial Planning

People who have written plans. . .

- Have clarity of purpose

- Are not as afraid of the future

- Plan for retirement

- Accumulate wealth

- Can protect their most precious assets

- Impact the lives of others

Watch this video on Financial Planning